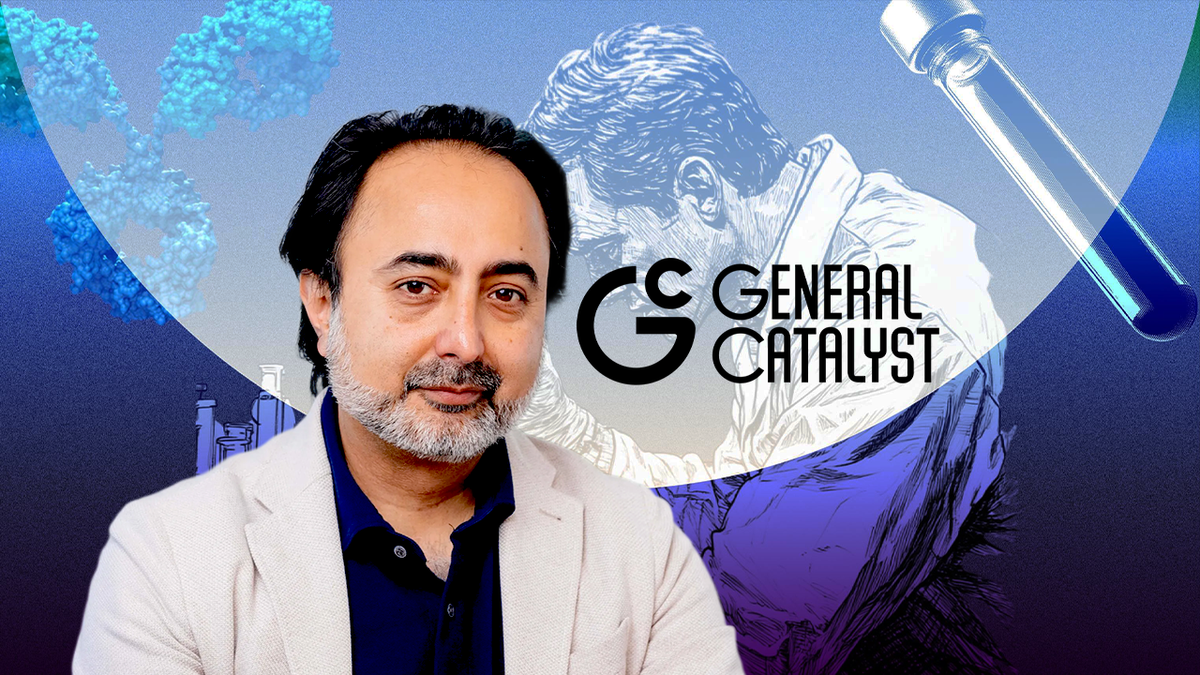

General Catalyst, a venture capital firm based in the US, has revealed plans to invest $5 billion in India within the next five years. This announcement was made during the India AI Impact Summit held in New Delhi. CEO Hemant Taneja stated that the investment will span various sectors including artificial intelligence, healthcare, fintech, defence, and industrial technology. He also mentioned that the firm intends to assist in the creation of new companies in India.

The $5 billion commitment marks a significant rise from General Catalyst’s previous involvement in India. The firm entered the Indian market in 2023 following the acquisition of early-stage venture capital firm Venture Highway. Before this acquisition, Venture Highway had already supported multiple Indian startups in their seed and early stages.

General Catalyst’s current portfolio in India features companies such as Zepto, PB Health, Raphe mPhibr, and Jeh Aerospace, as highlighted by media reports. The firm has made investments across both early and growth stages through its global funds.

According to Economic Times, Taneja indicated that India’s digital public infrastructure and skilled workforce were pivotal factors in this increased focus. He expressed that the firm aims to collaborate closely with founders and institutions to build companies within the region.

This announcement arrives at a time when numerous global investors and domestic groups have articulated substantial capital intentions for India across various technology and infrastructure sectors.