Highlights

Wakefit Secures Funding and Prepares for IPO

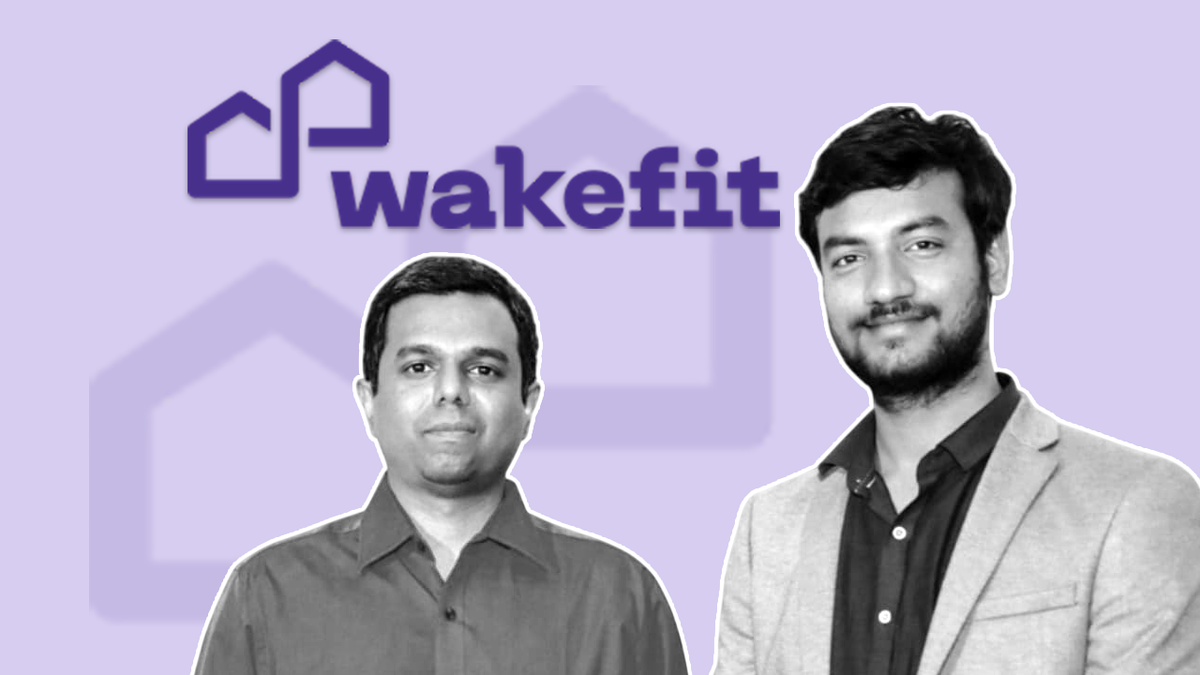

Wakefit, a prominent player in the sleep solutions market, has seen its co-founders, Ankit Garg and Chaitanya Ramalingegowda, receive 2.6 million equity shares through a rights issue ahead of the company’s public listing, as detailed in its Draft Red Herring Prospectus (DRHP).

In a notable development, existing investor Elevation Capital has purchased 2.03 lakh shares from Wakefit employees through secondary transactions since 2025. The shares were acquired at Rs 1,600 each, bringing the total transaction value to approximately Rs 32.5 crore.

IPO Filing Details

The Bengaluru-based company recently filed its DRHP to raise Rs 468 crore via a fresh issue of shares. The initial public offering (IPO) also includes an offer for sale (OFS) of 5.84 crore equity shares, attracting participation from investors like Peak XV, Verlinvest, SAI Global, Parmark, and Redwood Trust, among others. Notably, Elevation Capital has opted out of Wakefit’s offer for sale (OFS).

It is not uncommon for co-founders and key managerial personnel (KMP) to receive share allocations leading up to a company’s planned IPO. Just this week, Pine Labs CEO Amrish Rau was granted 2.3 crore shares prior to the filing of the company’s DRHP.

Company Overview

Founded in 2016, Wakefit operates as a direct-to-consumer (D2C) brand that focuses on sleep and home solutions. Its diverse product range includes mattresses, pillows, furniture, and other home improvement items, which are sold through its website, physical stores, and various third-party marketplaces.

Financial Performance

Examining its financials, for the first nine months of FY25, Wakefit reported a revenue of Rs 971 crore alongside a net loss of Rs 8.8 crore. The company earned 54.78% of its revenue through its own channels, with the remaining income derived from marketplaces and multi-brand outlets (MBOs).