Highlights

- 1 Thinking, Fast and Slow: Unveiling the Secrets of Decision-Making

- 1.1 Key Insights from Daniel Kahneman’s Thinking, Fast and Slow

- 1.1.1 1. System 1 and System 2: Understanding the Two Thinking Modes

- 1.1.2 2. Cognitive Ease: The Preference for the Familiar

- 1.1.3 3. The Halo Effect: The Influence of Singular Traits on Judgment

- 1.1.4 4. The Availability Heuristic: The Misjudgment of Common Events

- 1.1.5 5. Overconfidence: The Misconception of Knowledge

- 1.1.6 Also Read

- 1.1 Key Insights from Daniel Kahneman’s Thinking, Fast and Slow

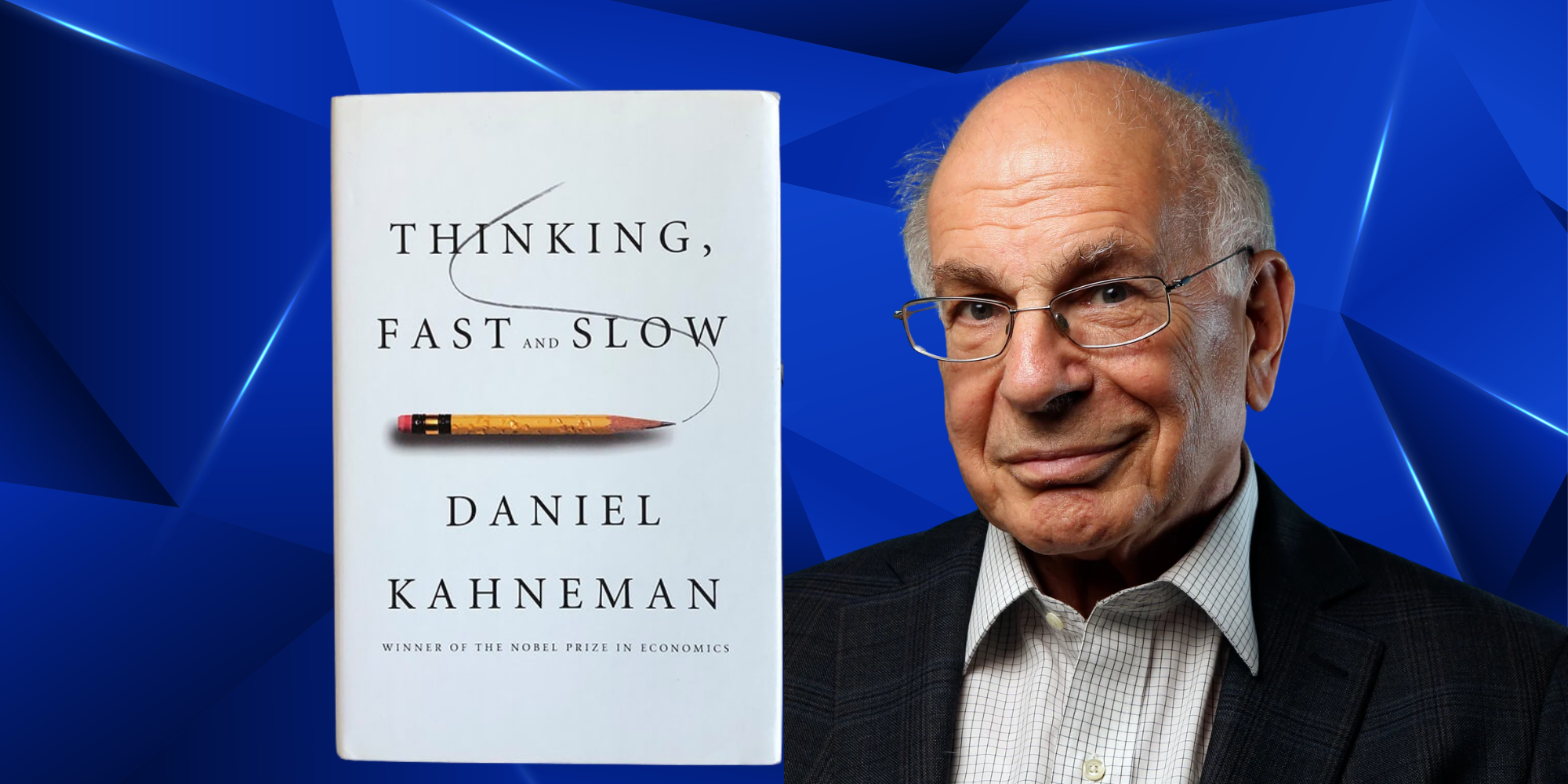

Thinking, Fast and Slow: Unveiling the Secrets of Decision-Making

What if everything one believes about thinking is incorrect? In Thinking, Fast and Slow, Nobel Prize-winning psychologist Daniel Kahneman dismantles the misconception that humans are rational decision-makers. Instead, he uncovers how our minds function with two conflicting systems: one that is quick and intuitive, and another that is slow and methodical. Both systems are filled with hidden biases, blind spots, and mental shortcuts.

From the reasons behind our tendency to overestimate our judgment to how we fall victim to randomness, Kahneman’s revolutionary work not only elucidates human behaviour but also explains how choices are made. Whether making decisions or assessing risks, this book promises to alter perceptions about thinking. Are you prepared to discover the truth about how thoughts are processed? Let’s explore.

Key Insights from Daniel Kahneman’s Thinking, Fast and Slow

1. System 1 and System 2: Understanding the Two Thinking Modes

Kahneman introduces two modes that govern thought processes. System 1 is rapid, automatic, and intuitive, handling everyday tasks such as recognising faces or promptly responding to sudden noises. Conversely, System 2 is slower, more deliberate, and logical, activating when addressing complex issues like solving mathematical problems or making significant decisions.

Why this is essential: There is a tendency to depend excessively on System 1, which results in quick judgments and mistakes. Knowing when to engage System 2 can enhance decision-making.

2. Cognitive Ease: The Preference for the Familiar

The brain seeks comfort and familiarity. Cognitive ease refers to how easily information is processed. When an idea seems familiar or straightforward (as with a clear font or a repeated message), there is a higher likelihood of accepting it as true, even if it lacks validity.

For instance, advertisers utilise repetition to make slogans memorable, increasing the likelihood of brand trust simply by virtue of frequent exposure.

This is significant because understanding cognitive ease prompts individuals to evaluate beliefs critically, questioning whether acceptance is based on accuracy or mere convenience.

3. The Halo Effect: The Influence of Singular Traits on Judgment

If one aspect of an individual is liked (such as their appearance, confidence, or success), there is a tendency to believe that all aspects are positive, often without evidence. This phenomenon is known as the halo effect. For example, a likable leader might be trusted unconditionally, even when their decisions may be questionable.

Why it’s important: The halo effect can distort perceptions in hiring, personal relationships, and leadership assessments. Recognising this bias aids in forming more objective evaluations of others.

4. The Availability Heuristic: The Misjudgment of Common Events

People often assess the probability of events based on the ease of recalling instances rather than relying on actual statistics. For instance, after hearing about a plane crash, one might overestimate the dangers of flying, when in fact, driving carries a higher statistical risk.

This matters because such biases lead to irrational fears and flawed risk evaluations. Fact-checking and data collection are invaluable in counteracting this heuristic.

5. Overconfidence: The Misconception of Knowledge

Many individuals, particularly experts, tend to overestimate their understanding and predictive skills. Kahneman describes this as the “illusion of validity.” For example, a stock trader may believe in their ability to consistently outperform the market, despite evidence supporting that the majority cannot.

Why this is crucial: Embracing humility and seeking constructive criticism can help reduce overconfidence, resulting in more informed decisions.

Also Read

5 mental models for success: The secret to smarter decisions