Highlights

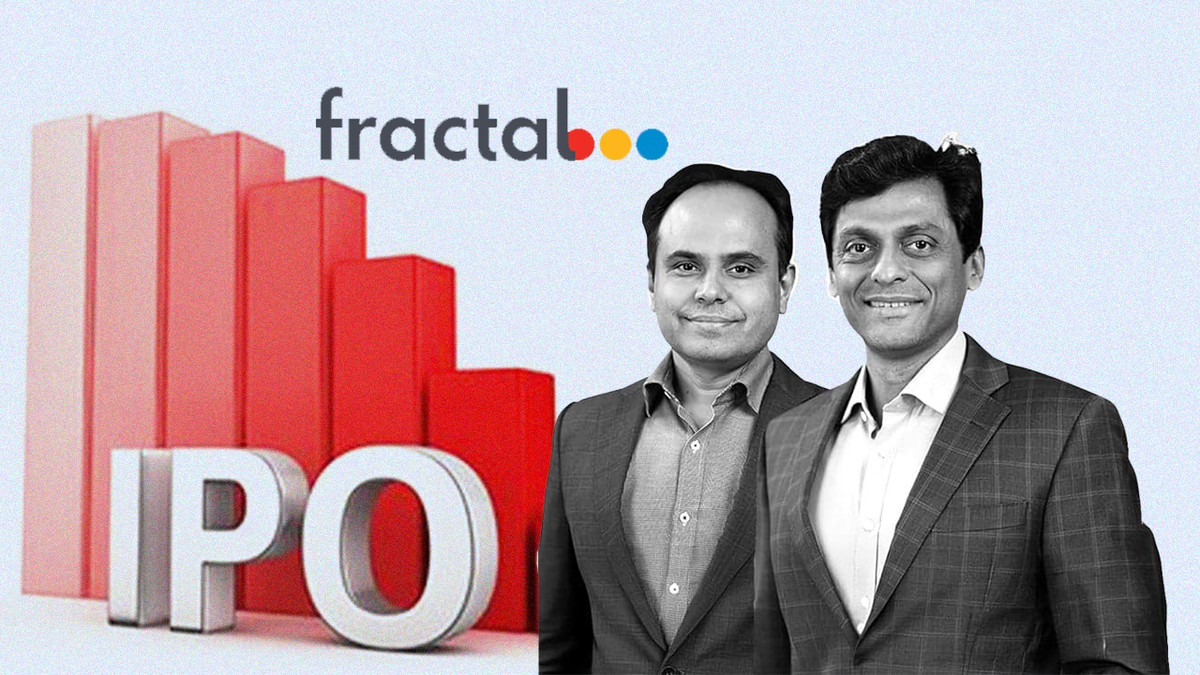

Fractal Analytics: AI Focused Analytics Firm’s Stock Performance

Fractal Analytics, an analytics firm specialising in artificial intelligence, had a quiet entry on the stock exchanges on Monday, listing below its issue price despite positive expectations for its standalone AI business. The company’s shares commenced trading at Rs 876 on the National Stock Exchange, approximately 3% lower than the upper limit of its IPO price band of Rs 900. A similar pattern was noted on the Bombay Stock Exchange.

Subscription Period Highlights

This understated debut follows a period of moderate interest during its IPO subscription. The offering was oversubscribed at nearly 2.66 times by the end of the bidding process. Data from the exchanges showed that Qualified Institutional Buyers (QIBs) subscribed 4.18 times, while Non-Institutional Investors (NIIs) subscribed at 1.06 times. However, the retail investor segment exhibited lacklustre demand, with subscriptions reaching just 1.03 times.

Revised Initial Public Offering Details

Fractal’s public issue saw a significant reduction of 42%, amounting to Rs 2,834 crore, down from the Rs 4,900 crore IPO detailed in its draft red herring prospectus (DRHP) last year. The updated IPO will consist of a fresh issue of shares worth Rs 1,023.5 crore and an offer for sale (OFS) amounting to Rs 1,810.4 crore from existing shareholders. The funds raised from the fresh issue are slated to support inorganic growth, invest in subsidiaries, fulfil working capital needs, and cover general corporate expenses.

Company Overview and Financial Performance

Established in 2000, Fractal delivers artificial intelligence and advanced analytics solutions to global businesses across various sectors, including consumer goods, retail, healthcare, technology, and financial services. The majority of the company’s revenue is generated from international markets, particularly within the US.

Financial Results

Financially, Fractal posted consolidated revenue of Rs 2,765 crore for the fiscal year 2025, an increase from Rs 2,196 crore in fiscal year 2024. The company reported a net profit of Rs 220.6 crore in FY25, a turnaround from a loss of Rs 54.7 crore recorded in FY24. For the first half of FY26, revenues reached Rs 1,559 crore, with a profit of Rs 71 crore.