Unveiling the True Price of Digital Friction: The Role of Product Analytics in Overcoming Challenges

Billions are invested in workplace systems, but digital friction costs productivity and hinders transformation.

Unveiling Founders’ Financial Oversights: Misunderstanding Burn Rate, Customer Acquisition Cost, and Profitability

Founders often have a financial blind spot, misunderstanding burn rate, CAC, and profitability metrics.

The Crucial Role of Whistleblower Systems in Detecting Fraud in Startups

"Empower yourself with comprehensive playbooks, expert analysis, and invaluable insights."

Revolutionizing Auto Industry Standards: India’s Groundbreaking AI Governance Framework

The India AI Governance Guidelines transform the auto sector, emphasizing safety, accountability, and data privacy.

Navigating the Future: How Smart Capital Will Regain Its Edge in 2025

"Empower yourself with playbooks, expert analysis, and insights to navigate the journey to startup success."

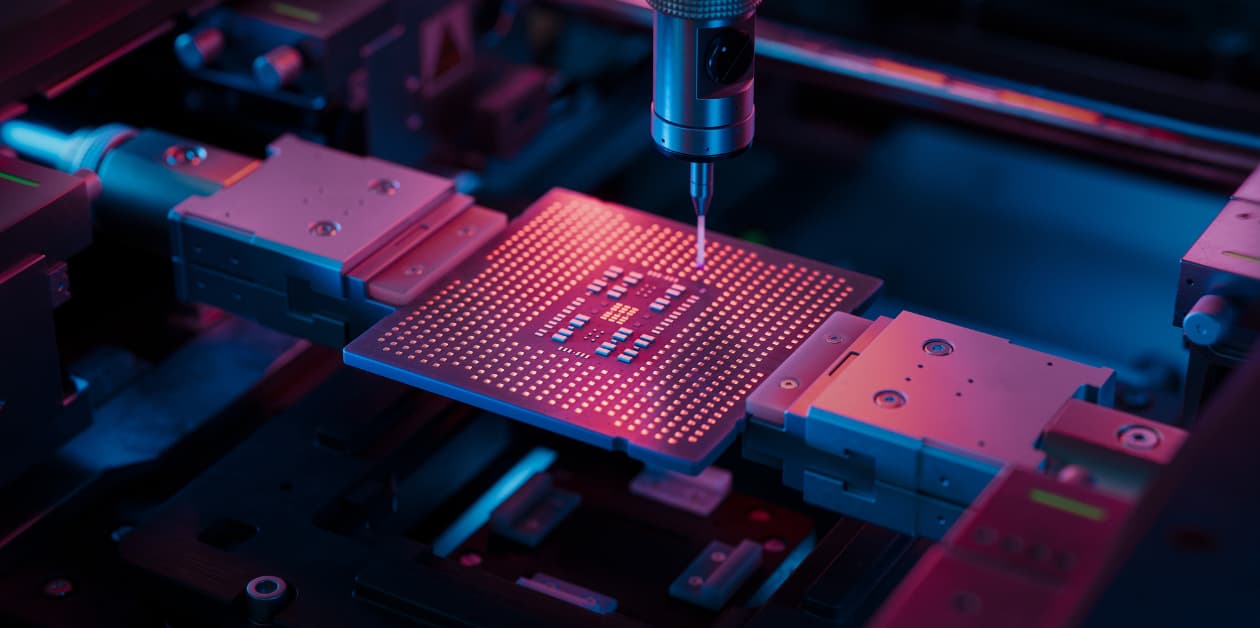

Crafting India’s Future in Semiconductors: The Journey Toward Building the Next NVIDIA

NVIDIA has transformed into a key player in AI, while India aims to follow suit with its RDI Fund.

Navigating the Future: The Symbiotic Evolution of AI and SaaS

AI is not the end of SaaS; it's the evolution that enhances accessibility, scalability, and flexibility.

Empowering Venture Capital: The Role of Data Analytics and AI in Informed Investment Strategies

AI transforms VC by enhancing efficiency, allowing hybrid investors to combine intuition with data-driven insights.

Empowering India’s Digital Revolution: The Impact of Venture Capital on Public Infrastructure

India is creating a Digital Public Infrastructure (DPI) that advanced economies are trying to understand.

The Swipe-Driven Era: India’s Revolution in Capturing Attention

The average Indian spends 10 hours weekly on social apps, interacting and transacting in the attention economy.