“`html

Highlights

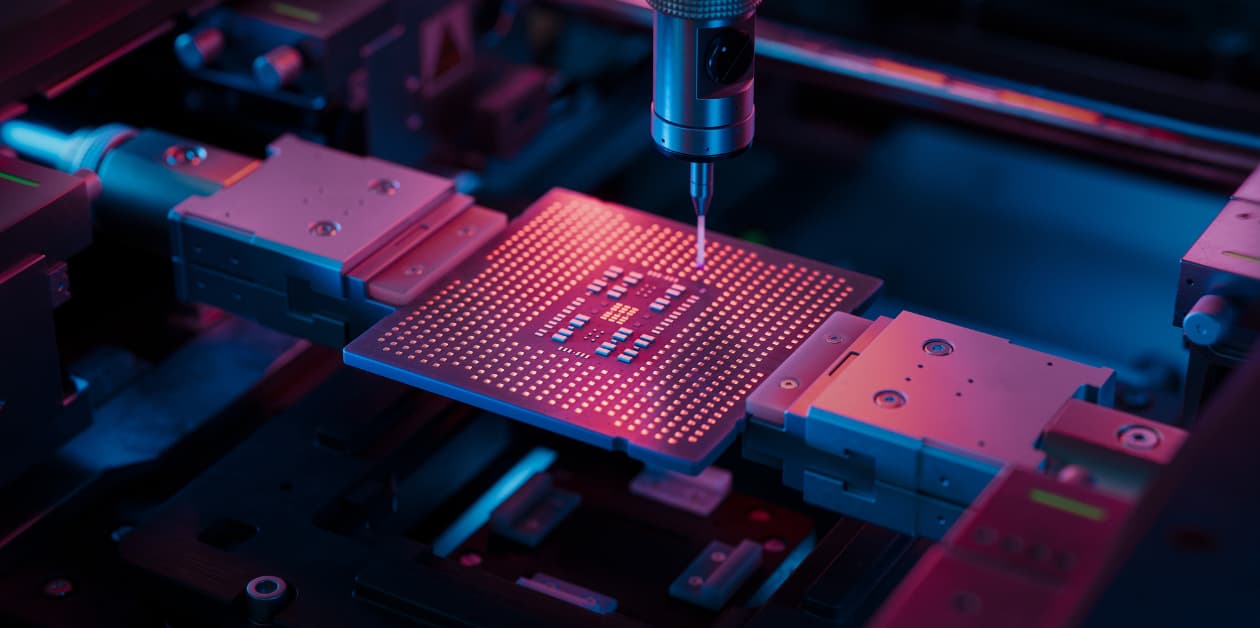

How India Can Build The Next NVIDIA

How India can build the next NVIDIA is a crucial topic as the country sits at a pivotal moment in technology. In under thirty years, NVIDIA has evolved from a startup focused on graphics chips to a cornerstone of the global AI landscape, boasting a valuation exceeding $5 trillion by 2025, surpassing giants like Apple, which is valued at $3.99 trillion, Amazon, and Google. Its GPUs now fuel innovations ranging from ChatGPT to self-driving cars.

The Journey of NVIDIA

The narrative of NVIDIA encompasses more than just the vision of its founder; it delves into elements such as human resilience, breakthroughs in silicon technology, unwavering determination, deferred rewards, patient investment, innovative processes, fair compensation for talent, and strategic expansion into related markets. This has been supported by an ecosystem that robustly encourages the transformation of scientific advancements into large-scale market products.

India’s Strategic Inflection Point

India finds itself on the brink of a similar transformation. With the Prime Minister launching the INR 1 lakh crore Research, Development and Innovation (RDI) Fund, the nation is signalling its commitment to evolve from being a consumer of global technologies to becoming an innovator in its own right.

The objective is to cultivate homegrown leaders in sectors such as semiconductors, AI, quantum computing, advanced materials, and defence systems—potentially even establishing India’s own version of NVIDIA.

Three Key Dimensions for Exploration

There are three essential areas to explore, plan, and implement:

High-Capex Ecosystem for Domestic Compute and Data Sovereignty

To create a thriving ecosystem, key factors can be categorised as follows:

- Founders: India boasts abundant talent with international experience, and government initiatives have effectively supported founders and the startup culture nationwide.

- Talent: The country benefits from top-tier institutions that have significantly contributed to both Indian and Western research and development. Indian corporates must enhance their R&D efforts.

- National Mission: Achieving data and compute sovereignty is critical to overcoming external AI constraints and safeguarding citizens’ Right to Privacy.

- Market Demand: The substantial and aspirational Indian population seeks premium experiences, highlighting a significant market opportunity that will reward investments in silicon innovation.

- Infrastructure and Operational Efficiencies: A considerable overhaul is needed in Indian frameworks, both in mindset and practical application.

Areas for Improvement

Key areas include:

- Income Tax and Customs: It is essential to eliminate officials who misuse AI tools or have discretionary powers that lead to unjust demands. Access to IT data and AI tools should be granted to citizens to level the playing field during interactions with bureaucracy.

- Land Acquisition: Streamlining land acquisition through a single-window approach can simplify processes.

- Utility Services: Consistent, reliable, and affordable supplies of electricity, water, raw materials, and transport are essential.

Capital Investment Strategies

Key considerations for capital investment include tax benefits and expedited approvals for significant projects:

- Tax Regimes: The Central Board of Direct Taxes (CBDT) must offer tax holidays and favourable interpretations for long-term venture capital investments supporting the National Mission.

- Regulatory Approvals: The Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) should facilitate quick approvals for substantial capital projects aimed at establishing sovereign compute and data capabilities.

Rule of Law and Intellectual Property

India’s IP protections enjoy a strong reputation in the West. Swift judicial resolutions for property access and physical safety are crucial for fostering a secure investment environment.

Lithography Technologies for Current Silicon-Based Architectures

Focusing on node sizes used by fabs reveals three commercially viable segments and distinct strategies:

- Large-nm (180 nm to 65 nm): This range offers a sweet spot for cost-effective, low-tech, and high-volume chips.

- Medium-nm (45 nm to 10 nm): This area is ideal for cost-effective, high-functionality chips; India could import older fabs from friendly nations like South Korea to bolster local capabilities.

- Small-nm (7 nm and below): Deep Ultraviolet Lithography (DUV) can produce 7 nm nodes; however, mastering Extreme Ultraviolet Lithography (EUV) is vital for achieving 5 nm to 1 nm capabilities.

Emerging Technologies

Beyond traditional silicon architectures, there are promising technological avenues worth exploring:

- Compute-in-Memory: This approach suits India well as it employs medium-nm technologies, providing enhanced speed and energy efficiency compared to conventional architectures.

- RISC-V: An open standard ISA that can be freely utilised for CPU development.

- POSITs: An alternative to IEEE 754 for floating point calculations, offering enhanced power efficiency.

- Optical Computing and Silicon Photonics: Suitable for high-speed computing and data communication applications.

The Future of Semiconductors

The semiconductor landscape is pivotal for future advancements, with the global market projected to exceed $1.1 trillion by 2030. Enhanced computing power is integral to various sectors including AI, telecommunications, and medical advancements. Yet, the supply chain remains largely concentrated, with over 70% of advanced chips manufactured in East Asia. This dependence presents significant challenges for India, the fastest-growing digital economy. The rising demand for AI-specific chips and custom silicon for industrial and defence applications presents both a challenge and an opportunity.

NVIDIA’s ascension provides valuable insights; beginning as a fabless design firm focused on a specific market before branching into AI and data centres has demonstrated that deep expertise and long-term commitment can result in trillion-dollar enterprises. Similarly, Taiwan’s TSMC emerged through public-private cooperation, while Israel’s innovation economy was cultivated from defence R&D into broad commercial technologies. India’s approach should integrate academic depth, policy support, and entrepreneurial drive.

The RDI Fund positions India with a powerful tool to meld research, innovation, and entrepreneurship effectively, turning the vision for a semiconductor industry into tangible reality. In today’s landscape, the silicon chip is the new symbol of national capability, and strategic planning is essential. As India approaches the AI and advanced manufacturing era, it must understand that building chips involves crafting a roadmap for an independent future.

“`